In the world of Forex trading, currency pairs are the cornerstone of the market. A currency pair is a combination of two currencies that are traded against each other in the foreign exchange market. Understanding the different types of currency pairs is essential for traders to make informed decisions when buying and selling currencies. In this blog post, we will discuss the three types of currency pairs in Forex trading.

- Major Currency Pairs

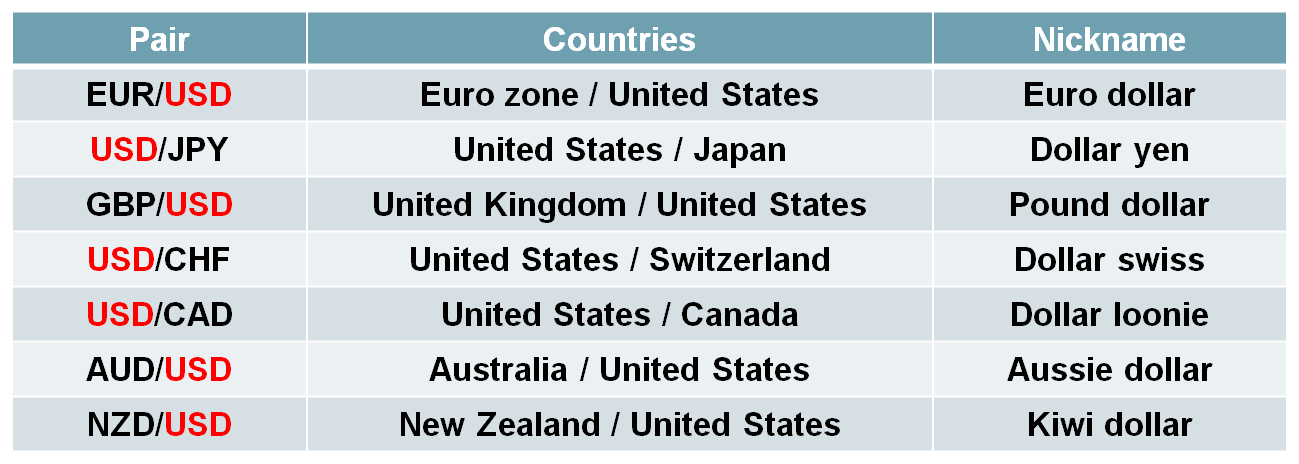

Major currency pairs are the most widely traded currency pairs in the Forex market. These pairs consist of the US dollar and other major currencies, such as the Euro, Japanese Yen, British Pound, Swiss Franc, Canadian Dollar, or Australian Dollar. The major currency pairs are:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

- USD/CAD (US Dollar/Canadian Dollar)

- AUD/USD (Australian Dollar/US Dollar)

These currency pairs are heavily influenced by global economic events and policy decisions, and as such, they are often volatile and can offer significant trading opportunities.

- Minor Currency Pairs

Minor currency pairs, also known as cross-currency pairs, consist of two major currencies that are not paired with the US dollar. These currency pairs are traded less frequently than major currency pairs and are generally less liquid. Some examples of minor currency pairs are:

- EUR/GBP (Euro/British Pound)

- EUR/CHF (Euro/Swiss Franc)

- GBP/JPY (British Pound/Japanese Yen)

- AUD/CAD (Australian Dollar/Canadian Dollar)

Minor currency pairs can offer unique trading opportunities for traders who have a good understanding of the economic conditions and factors that affect the two currencies in the pair.

- Exotic Currency Pairs

Exotic currency pairs consist of one major currency and one currency from an emerging or developing economy. These currency pairs are the least traded and are generally considered more volatile than major or minor currency pairs. Some examples of exotic currency pairs are:

- USD/HKD (US Dollar/Hong Kong Dollar)

- USD/SGD (US Dollar/Singapore Dollar)

- USD/BRL (US Dollar/Brazilian Real)

- USD/MXN (US Dollar/Mexican Peso)

Due to the limited liquidity in these currency pairs, trading costs can be higher, and the spreads can be wider than for major and minor currency pairs. Traders who choose to trade exotic currency pairs must have a good understanding of the economic and political conditions of both countries in the pair.

Conclusion

The Forex market offers a wide range of trading opportunities, and understanding the different types of currency pairs is essential for traders to make informed trading decisions. Major currency pairs are the most widely traded and offer the most liquidity and volatility. Minor currency pairs offer unique trading opportunities for traders who have a good understanding of the two currencies in the pair. Exotic currency pairs are the least traded and can be more volatile, making them suitable for more experienced traders. As with any trading, it is important to conduct thorough research and risk management before engaging in Forex trading.

Are you ready to take ACTION and learn the strategies and techniques for profitable forex trading? This ebook will provide you with the ultimate guide to help you become a successful forex trader.

Leave a Reply